- 1. An Introduction to Small- and Medium-Sized Enterprise (SME) Trade in Vietnam

- 2. What regulatory conditions do I have to satisfy to import goods into Vietnam from the EU?

- 2.1. What tariffs, tariff rate quotas and rules of origin regulations might apply to goods I want to import into Vietnam from the EU?

- 2.2. What documentation requirements and customs procedures might be applicable to my goods imports?

- 2.2.1. General requirements for most goods imports

- 2.2.2. What are the documentation requirements and customs procedures specific to importation of agricultural and fishery products?

- 2.2.3. What are the documentation requirements and the customs procedures to importation of tobacco?

- 2.2.4. What are the documentation requirements and the customs procedures for the importation of food and beverages?

- 2.2.5. What are the documentation requirements and the customs procedures for the importation of iron and steel?

- 2.2.6. What are the documentation requirements and the customs procedures for the importation of precious metals?

- 2.2.7. What are the documentation requirements and customs procedures specific to importation of chemicals?

- 2.2.8. What are the documentation requirements and customs procedures specific to importation of pharmaceuticals?

- 2.2.9. What are the documentation requirements and customs procedures specific to importation of electronic data processing, office and telecommunications equipment?

- 2.2.10. What are the documentation requirements and customs procedures specific to importation of automobile products (vehicles and component parts)?

- 2.2.11. What are the documentation requirements and customs procedures specific to importation of power generating machinery?

- 2.2.12. What are the documentation requirements and customs procedures specific to importation of medical devices?

- 2.3. What import controls or non-tariff barriers might apply to my products?

- 2.3.1. What products are prohibited from import into Vietnam?

- 2.3.2 Which types of products require import permits or licenses?

- 2.3.3. What technical requirements might apply to my imports, and how can I show proof of conformity with domestic and international standards?

- 2.3.3.1. General technical requirements and conformity assessment documentation

- 2.3.3.2. What are the technical requirements for imported medical equipment?

- 2.3.3.3. What are the technical requirements for imported pharmaceutical products?

- 2.3.3.4. What are the technical requirements for imported cars?

- 2.3.4. What are the current sanitary and phytosanitary (SPS) requirements for product imports into Vietnam?

- 2.3.5. What domestic Vietnamese taxes may apply to my imported products?

- 2.3.6. What information must be included on my products’ labels?

- 2.4. What trade remedies might Vietnam apply against my imports?

- 3. What regulations apply to the distribution of my goods within the Vietnamese market after I have imported them?

- 4. How can I export services to Vietnam from the EU?

- 5. What are Vietnam’s e-commerce platforms, at what regulations might I need to follow to utilize them?

- 5.1. What are Vietnam's major e-commerce platforms?

- 5.2. How are payments handled on Vietnamese e-commerce platforms?

- 5.3. What regulations and policies can apply to me when selling products through e-commerce platforms?

- 5.4. What are the returns policy for cross border e-commerce?

- 5.5. What are the inspection and quarantine requirements for cross border e-commerce imports into Vietnam?

- 6. What intellectual property rights might apply to the products and services I want to export to Vietnam?

- 6.1. Intellectual property protections through Vietnamese domestic law and the EVFTA

- 6.2. How do I register my IP in Vietnam?

- 6.3. How much does it cost to register my IP?

- 6.4. How long can it take to register IP rights?

- 6.5. Are there protections for any unregistered IP?

- 6.6. How can I enforce my IP rights in Vietnam if I feel they are being breached?

- 6.7. What is the SME IP Rights Helpdesk and how can it help my business?

- 7. As an EU investor, how can I go about investing in Vietnam?

- 7.1. How do the EVFTA and EVIPA help me invest in Vietnam?

- 7.2. What are my options for structuring my company in Vietnam, and how can I go about registering my company?

- 7.3. Investment regulations and documentation requirements

- 7.4. Are there any sectors with additional special rules for foreign investors?

- 7.5. What are the applicable taxes for businesses?

- 7.6. What are the requirements for data storage applicable for foreign enterprises?

- 7.7. Do I have access to credit as an SME in Vietnam?

- 7.8. What grants, funding or mentorship schemes might my SME qualify for?

- 8. How can I apply for public procurement tenders in Vietnam?

- 9. What do I need to know about the EVFTA chapter on trade and sustainable development?

- 10. What methods of legal recourse or dispute resolution might be available to me?

- 11. Additional useful links and contact information

- Legal Notice and Disclaimer

| This electronic guide serves to provide European SMEs interested in trading with Vietnam, alongside other interested stakeholders, a first point of call. It offers a set of initial answers to questions businesses may have, includes links to further details and documentation, and is updated regularly. Whilst this guide has been prepared by leading experts and with great care, it does not constitute legal advice. Your critique, comments and suggestions are most welcome via our feedback form. |

1. An Introduction to Small- and Medium-Sized Enterprise (SME) Trade in Vietnam

1.1. What should I know about Vietnam?

Hanoi and Ho Chi Minh City are, according to the City Momentum Index 2020 report, ranked among the top-10 most dynamic cities in the world due to their low cost, rapid consumer market expansion, strong population growth, and transition towards activities attracting significant amounts of foreign direct investment.

Vietnam is one of the fastest-growing economies in the world with, according to the World Bank, 7.1% and 7% percent GDP growth in 2018 and 2019 respectively. Although its growth rate declined to 2.91% in 2020 due to the Covid-19 pandemic, it remains among the highest in the region, and globally.

Additionally, Vietnam has the fastest-growing middle class in the region. Vietnam’s middle class accounts for 13% of the total population with this figure is expecting to reach 26% by 2026. Vietnam’s super-rich population is also growing faster than elsewhere in the region, and there is no doubt it will continue to rise over the next ten years.

The implementation of the EVFTA stimulated growth in bilateral trade between Vietnam and the EU with two-way trade turnover reaching USD 17.8 billion during the first four months of implementation (August-November 2020) - an increase of 2.9% relative to the same period in 2019.

1.1.1. What etiquette should I be aware of when seeking to do business in Vietnam?

- Vietnamese prefer discussions to be held in person rather than online, unless the latter is the only option (i.e. due to lockdown imposed by the Government amid the Covid-19 pandemic). Although English is gaining popularity, whenever possible, we recommend you have a translator with you. Ideally, you should learn to speak a few simple words in Vietnamese to show that you respect the culture and will endeavour to make the business deal;

- Similarly, your business card should be in both English and Vietnamese. When giving or receiving business cards, do so with both of your hands;

- Seniority and hierarchy are important in Vietnam. When working with an older male, refer to him as “Anh” followed by his first name. When working with an older female, refer to her as “Chị” followed by her first name. When shaking hands or handing business cards or documents, always address the people with the highest seniority first;

- Vietnamese names follow the format of family name-middle name-first name. Some people have more than one middle name and some don’t have any. People refer to each other by their first name, or their middle name and first name (to differentiate from others with the same first name),but never their family name;

- It is highly recommended to have all work documents translated to Vietnamese;

- Vietnamese businesspeople tend to reply to investors introduced to them via a mutual connection, rather than cold calling.

1.1.2. What visa rules might apply to me when travelling to Vietnam to do business?

In order to enter Vietnam, foreigners need to obtain entry visas issued by the Department of Immigration under Vietnam’s Ministry of Public Security (for issuance and renewal).

Visas can be obtained digitally. Vietnam has updated the process and procedures for the e-visa system, allowing visitors of single-entry visits with a duration of up to 30 days to apply for and obtain their visas online. The processing time for e-visas is three working days after completing registration and making the fee payment. You can find the link to apply for e-visas here.

Citizens of Denmark, Finland, France, Germany, Italy, Norway, Spain, and Sweden, can enter Vietnam visa-free for up to 15 days.

To work in Vietnam and remain for an extended period of time, foreigners need to apply for longer-term (three-month) single or multiple entry visas. It is advised to check with the Vietnamese Consulate General or Embassy in your country of residence on matters related to the application for longer-term visas (such as foreign workers visas or others).

Additional information regarding stays for businesspeople in specific sectors can be found in Section 4.3.2.

1.2. What does it mean to be an SME in Vietnam?

1.2.1. What is an SME, and does my business qualify as one?

SMEs describe microenterprises, small enterprises and medium-sized enterprises as determined in Article 6 of Decree No. 80/2021/ND-CP. The determination of SMEs according to the Decree follows two sets of criteria; (1) the sectoral group the enterprise operates in and (2) its average number of employees, annual revenue, and total investment capital. The determination is defined as follows (further information can be found here):

| Sectors/Criteria | Agriculture, forestry and aquaculture, industrial, construction | Trade and services |

|---|---|---|

| The average number of employees participating in social insurance per year | Microenterprise: 10 or fewer Small enterprise: 100 or fewer Medium enterprise: 200 or fewer | Microenterprise: 10 or fewer Small enterprise 50 or fewer Medium enterprise 100 or fewer |

| Annual revenue (VND billions) | Microenterprise: maximum 3 Small enterprise: maximum 50 Medium enterprise: maximum 200 | Microenterprise: maximum 10 Small enterprise: maximum 100 Medium enterprise: maximum 300 |

| Total investment capital (VND billions) | Microenterprise: maximum 3 Small enterprise: maximum 20 Medium enterprise: maximum 100 | Microenterprise: maximum 3 Small enterprise: maximum 50 Medium enterprise: maximum 100 |

If a company has any queries about its categorization, it can refer to the SME Assistance Portal managed by the Ministry of Planning and Investment. The Portal contains information about the network of SME assistance counsellors, SME assistance plans, programs, projects, schemes, activities; guidelines for business operation, credit, market, products, technology, business incubation and other information serving operation of SMEs, state management of assistance and development of enterprises according to demands of the organizations and individuals.

1.2.2. How do SMEs currently contribute to the Vietnamese economy?

What are the most common categories of SMEs?

Small and micro enterprises (both local and foreign-invested) account for a very large proportion of SMEs in Vietnam, whereas the number of medium sized enterprises accounts for only 1.6% of SMEs.

In which sectors are SMEs most prevalent?

Local and foreign-invested SMEs account for around 96.7% of total enterprises in Vietnam (as of September 2020). Most SMEs operate in the commerce, services and industrial sectors especially in traditional handicraft, exploiting and producing raw products such as minerals, seafood, forest products, processing and assembly, manufacturing high-tech products (machinery, electronics, chemicals, measuring equipment, engines, etc.).

In recent years, the trend of developing innovative business models (in the form start-ups, which are considered as SMEs in Vietnam) has been growing, especially in areas like construction, processing, manufacturing, the automotive industry, air transport, finance and banking. Currently, there are more than 3,000 active start-ups, most of them funded by start-up investment funds from the US and Singapore.

How ready are SMEs in Vietnam for the 4.0 industrial revolution

With a young and technology savvy workforce, increased connectivity and the presence of many large global technology corporations, rapid technology innovation and adaptation is diffusing fast amongst Vietnamese SMEs. The International Labour Organization’s analysis on the readiness of Vietnam’s labour market to innovate and adapt to technology in the workplace can be read here.

How many people are employed in SMEs in Vietnam?

The latest data shows that between 2016-2017 the SME sector attracted 8.69 million employees. In the two years 2017-2018, the number of newly established SMEs created nearly 2.3 million new jobs.

How do SMEs contribute to the Vietnamese economy?

According to Vietnam’s Academy of Social Sciences, in recent years SMEs contribute annually approximately: 40% to Vietnam’s GDP, 30% to the state budget, 33 per cent of industrial output value, 30% of export value and attract nearly 60% of employees nationwide.

1.3. What is the EVFTA?

The EVFTA is the most comprehensive and ambitious trade and investment agreement that the EU has concluded with a developing country in Asia, and is the second EU free trade agreement concluded in the ASEAN region after the Singapore FTA.

The EVFTA is envisaged to intensify bilateral trade and investment relations between Vietnam and the EU, and is working towards developing Vietnam into an Asian manufacturing hub.

In services, Vietnam has not only liberalized additional sub-sectors for EU service providers under the EVFTA, but also made deeper commitments than those made under WTO Agreements, offering EU service providers the best possible access to Vietnam’s market. Some services sub-sectors covered by the EVFTA are: interdisciplinary Research & Development (R&D); nursing, services provided by physiotherapists and para-medical personnel; packaging; trade fairs and exhibitions, and building-cleaning.

In addition, for the sectors listed in Vietnam’s Specific Schedule of Commitments under the Agreement, except where there are specific reservations, Vietnam undertakes not to apply restrictions related to: (i) the number of businesses allowed to participate in the market; (ii) the transaction value; (iii) the number of activities; (iv) foreign capital contribution; (v) the form of legal entities; and (vi) the number of natural persons recruited.

In goods trade, Vietnam has committed to eliminate import duties on 48.5% of tariff lines, equivalent to 64.5% of EU exports to Vietnam from 1 August 2020.

In public procurement, Vietnam committed to treat EU bidders, or domestic bidders with EU investment capital, equally like Vietnamese bidders when the Government purchases goods or requests services worth over a specified threshold.

You can find the full text of the EVFTA here.

2. What regulatory conditions do I have to satisfy to import goods into Vietnam from the EU?

This section will summarize most applicable regulations that may concern goods imports into Vietnam from the EU, including tariff rates and tariff rate quotas, rules of origin, documentation requirements, customs procedures, import controls, non-tariff barriers and trade remedies.

2.1. What tariffs, tariff rate quotas and rules of origin regulations might apply to goods I want to import into Vietnam from the EU?

2.1.1. The import tariff schedule

The preferential import tariff schedule of Vietnam under the EVFTA (effective from 1 August 2020 to 31 December 2022) can be found here. The preferential import tariff schedule for the next periods will be issued by the Government of Vietnam at a later stage, normally one month before or after the start of a new effective period. The Ministry of Industry and Trade issues the annual quotas for these products every year.

2.1.2. Import tariff rate quotas

Import tariff rate quotas are applied to the following products and quantities:

- Raw tobacco (HS Code 2401): 62,053 tons (18 January 2021 to 31 December 2021);

- Chicken eggs (HS codes 0407.21.00 and 0407.90.10), duck eggs, swans (HS codes 0407.29.10 and 0407.90.20), and others (HS codes 0407.29.90 and 0407.90.90): 60,819 tons (2021);

- Salt (HS code 2501): 80,000 tons (2021);

- Sugar (HS code 1701): 108,000 tons (2021).

In-quota imports of these products from the EU to Vietnam are subject to the preferential import tariff rate stipulated in the schedule. Imports of these products in quantities beyond the above quotas are subject to general MFN tariff rates.

To enjoy preferential in-quota tariff rates, importers need to obtain an import quota license from the Ministry of Industry and Trade. The application dossier, to be submitted to the Import- Export Department of the Ministry of Industry and Trade, shall include:

- An original request for import tariff quotas made according to this form (available only in Vietnamese);

- A self-certified true copy of an Investment Registration Certificate or Enterprise Registration Certificate of the importer.

Please note that for the import of tobacco raw materials, the importer must have a license to produce cigarettes issued by the Ministry of Industry and Trade and have a demand to import tobacco raw materials for cigarettes production.

The pilot auction program that was being run for tariff-rate quotas on imports of refined and raw sugar has ended, being replaced by Circular No. 11/2022/TT-BCT. This law does not apply tariff quotas on imported sugar being imported for processing and then re-export. Under this new law, the Ministry of Agricultural and Rural Development decides on the quantity and volume of sugar that the tariff-rate quotas will apply to. The Ministry of Industry and Trade then decides on how these quotas will be allocated.

Importers wishing to participate in the auction must:

(i) pay a deposit equivalent to 10% of the value of the amount of sugar they are registering to be distributed via the auction (this number being calculated relative to the starting price of the product at the auction); and

(ii) submit an application dossier to the Ministry of Industry and Trade Import-Export Department for approval (this form is available via the above link).

2.1.3. Rules of origin

Generally applicable rules of origin

Your products are considered as originating from the EU under the EVFTA if they are:

- Products wholly obtained in the EU (i.e., plants, minerals, live animals); or

- Products produced in the EU incorporating materials which have not been wholly obtained there, provided that such materials have undergone sufficient working or processing within the EU.

While it is simple for wholly obtained products in the EU to be considered as originating from the EU, the EVFTA sets out a set of working or processing procedures for products based on their HS Codes to qualify for origin status. Therefore, you will need to check the HS codes of products intended to be imported into Vietnam to find their respective originating requirements.

The following operations are not considered as sufficient working or processing to confer origin:

- Preserving operations to ensure that the products remain in good condition during transport and storage;

- Breaking-up and assembling of packages;

- Washing, cleaning, removal of dust, oxide, oil, paint or other coverings;

- Ironing or pressing of textiles and textile articles;

- Simple painting and polishing operations;

- Husking and partial or total milling of rice; polishing and glazing of cereals and rice;

- Operations to colour or flavour sugar or form sugar lumps; partial or total milling of crystal sugar;

- Peeling, stoning and shelling of fruits, nuts and vegetables;

- Sharpening, simple grinding or simple cutting;

- Sifting, screening, sorting, classifying, grading, or matching (including the making-up of sets of articles);

- Simple placing in bottles, cans, flasks, bags, cases, boxes, fixing on cards or boards and all other simple packaging operations;

- Affixing or printing marks, labels, logos and other like distinguishing signs on products or their packaging;

- Simple mixing of products, whether or not of different kinds; mixing of sugar with any material;

- Simple addition of water, dilution, dehydration or denaturation of products;

- Simple assembly of parts of articles to constitute a complete article or disassembly of products into parts;

- A combination of two or more of the operations specified above; or

- Slaughter of animals.

Rules of origin for fabrics/textile products?

There are some special rules regarding rules of origin for textile products. A good summary of these can be found here on the EU’s Access2Markets page on the EVFTA. Additionally, you can utilize the Access2Markets database to see what rules of origin affect your exact type of textile product.

How can I determine EU origin status, and what forms should I use?

As laid out on page 5 of the EVFTA guidance on rules of origin, EU products imported to Vietnam benefit from the EVFTA tariff preferences upon the submission of a statement of origin made by exporters registered in the Registered Exporter System (REX) - an electronic database – and in accordance with the relevant legislation in the EU. The text of the origin statement can be found here (Annex VI to Protocol 1 of the EVFTA – English version).

Registration in the REX database is valid throughout the customs territory of the EU and therefore the REX number assigned to an exporter may be used irrespective of the place where products are declared for exportation and the country of export.

The REX database does not require exporters to specify the countries for which the registration has been completed for. Therefore, an exporter already holding a REX number for purposes of exporting to GSP (Generalized Scheme of Preferences) beneficiary countries, may use the same REX number for purposes of exporting to Vietnam.

Further information on, and a link to, the REX database can be found here.

Some additional notes on the text of origin statements:

- For EU exporters exporting to Vietnam, the customs authorization number will be the registration number (REX number), not the approved exporter authorization number;

- For goods originating in the EU, the origin to be indicated in (2) is “EU”;

- Statements on origin made by registered exporters do not need to be signed;

- Exporters who are not registered exporters may still complete a statement of origin up to the value threshold of EUR 6,000, for each consignment. Such statements of origin must bear the signature of the exporter in manuscript. Therefore, the original document on which a statement of origin is made should be provided to the importer in Vietnam.

2.2. What documentation requirements and customs procedures might be applicable to my goods imports?

2.2.1. General requirements for most goods imports

The customs dossier

The customs dossier for imported goods from the EU under the EVFTA includes the following documents:

- A customs declaration of imported goods, whether using e-customs declaration form with the data fields by accessing this site with a registered account, or using this form (available only in Vietnamese);

- An import permit (if applicable) or the quota-based import license or a notification of tariff quota;

- A commercial invoice;

- If the goods owner buys the goods from a seller in Vietnam and is instructed by the seller to receive goods overseas, the customs authority shall accept the invoice issued by the seller in Vietnam to

the goods owner; - The declarant is not required to submit the commercial invoice in the following cases:

- When goods are imported to execute a processing contract with a foreign trader;

- When goods are imported without invoices and the buyer is not required to pay the seller;

- If the goods owner buys the goods from a seller in Vietnam and is instructed by the seller to receive goods overseas, the customs authority shall accept the invoice issued by the seller in Vietnam to

- A bill of lading (for goods imported for the purpose of oil and gas exploration and exploitation and transported on non-commercial service ships, the cargo manifest must be submitted in place of the bill of lading);

- An origin statement;

- An inspection certificate;

- The certificate of eligibility to import prescribed by investment law;

- A value declaration: the declarant shall make the value declaration using this form (available only in Vietnamese) and send the electronic declaration to the e-customs system or submit two original copies to the customs authority. Value declaration is not required in the following cases:

- Non-taxable goods, goods eligible for tax exemption or consideration for tax exemption;

- Goods that are imported in the form of importing raw materials for the manufacture of exported goods;

- Goods that are eligible for the transaction value-based method and for which the declaration of imported goods of Vietnam Automate Cargo And Port Consolidated System is sufficiently informed, allowing the system to determine the customs value automatically;

- Goods that are imported without a sale contract or commercial invoice.

- A list of machinery and equipment in case they are combination machines or set of machines falling under Chapters 84, 85 and 90 of Vietnam’s nomenclature of exports and imports, or they are unassembled or disassembled machinery and equipment;

- A contract to sell goods to a school or research institute, or a contract to supply goods or services that are imported to serve teaching or scientific experiments.

The certificate of origin; the inspection certificate; the certificate of eligibility to import prescribed by investment law; and the import permit (if applicable) or quota-based import license or notification of tariff quota can be sent electronically through the National Single-window Information Portal by the inspecting or regulatory authority, or through the Association of Southeast Asian Nations Single-window Information Portal by a competent authority of the exporting country, or through another portal dealing with the EVFTA. Both single windows are accessible through the Vietnamese National Single Window website.

General customs clearance procedures

The customs declaration dossier for imported goods must be submitted before the goods reach the border or within 30 days from the date when the goods reach the border. If the means of transport follow electronic customs procedures, the date of arrival of goods at the entry point is the date of arrival of the means of transport at the checkpoint as informed by the shipping company on the e-customs system. In cases where the means of transport follow manual customs procedures for entry, the date of arrival of goods at the checkpoint is the day on which the customs authority appends the seal on the declaration of imports at the port of discharge which is enclosed with documents about the means of transport (by sea, by air, or by rail) or the date written on the declaration of means of transport crossing the checkpoint or the logbook of means of transport (by river or by road).

The fully completed customs dossiers can be submitted online. After receiving the dossier, the system will check the conditions for registering the submitted customs declaration form, and if such conditions are met, the customs authority approves the registration. If there is a need for correction, it is possible to correct the data directly in the online customs dossier. The customs authority in charge will then decide on one of the following customs inspection forms and levels based on the result of the online system:

- Lane 1: Accept information on the declaration. The goods can be cleared from customs without having to go through further steps;

- Lane 2: Inspect relevant documents of the customs dossier submitted or presented by the declarant or relevant documents on the National Single-window Information Portal while being exempted from actual inspection of goods;

- Lane 3: Carry out physical inspection of goods based on inspected relevant documents of the customs dossier submitted or presented by the declarant or relevant documents on the National Single-window Information Portal;

In cases where a physical inspection is required, if the cargo or any sample of the cargo corresponds accurately with the information contained in the forms and documents, Customs will record the results of the inspection and will release the goods to the importer. The Customs Authority may require additional documents/information to complete its inspection. If the declarant cannot provide that information, or the goods are not allowed to be cleared from customs after inspection, the goods stay at the border or are returned by agreement of the importer, the exporter and/or the seller.

In addition, goods which have completed customs procedures but have not paid or fully paid the applicable tax amounts within the regulated time limit can be released if they have such payable tax amounts guaranteed by a credit institution, or enjoy a tax payment time limit in accordance with the tax law.

Further to the above, customs laws also provide customs procedures for goods in transit, goods brought into entrepots, free trade zones, bonded warehouses, duty free warehouses, for temporary import for export goods, for means of transport on entry, exit or in transit.

2.2.2. What are the documentation requirements and customs procedures specific to importation of agricultural and fishery products?

In addition to the general requirements, the importation of agricultural and fishery products is subject to additional requirements, described here.

2.2.3. What are the documentation requirements and the customs procedures to importation of tobacco?

In addition to the general requirements, the importation of tobacco raw materials is subject to import tariff quotas and an import quota license. In addition, the importer must submit a license to produce cigarettes issued by the Ministry of Industry and Trade and have a demand to import tobacco raw materials for cigarettes production.

The importation of tobacco products is under the sole authority of Vietnam National Tobacco Corporation (VINATABA) according to the mechanism of state trading.

2.2.4. What are the documentation requirements and the customs procedures for the importation of food and beverages?

See here on pages 27-28 for more information.

2.2.5. What are the documentation requirements and the customs procedures for the importation of iron and steel?

See general requirements under Section 2.2.1.

For a list of iron and steel subject to quality inspection, please refer to this list.

The importation of iron and steel listed above requires the submission of the proof of registration for quality inspection and of an announcement on technical standards conformity (a self-announcement registered by laws). See Section 2.3.3 for further information on conformity assessments.

2.2.6. What are the documentation requirements and the customs procedures for the importation of precious metals?

The importation of gold materials for manufacturing gold bars is within the State exclusive authority.

For import of other precious metals, please see the general requirements under Section 2.2.1.

2.2.7. What are the documentation requirements and customs procedures specific to importation of chemicals?

For chemicals prohibited from import please refer to Section 2.3.1.

The importation of chemicals listed in List 2 and List 3 in the Appendix issued with Decree 38 of the Government dated 6 May 2014 on management of chemicals under control pursuant to the Treaty Prohibiting Development, Production, Storage, Use and Destruction of Chemical Weapons, is subject to import licensing.

Importers must declare their imported chemicals on the national single-window here as a condition to clear their imports from customs.

2.2.8. What are the documentation requirements and customs procedures specific to importation of pharmaceuticals?

See general requirements under Section 2.2.1. For additional information, please see here.

2.2.9. What are the documentation requirements and customs procedures specific to importation of electronic data processing, office and telecommunications equipment?

See general requirements under Section 2.2.1. For telecommunications equipment, please see here.

2.2.10. What are the documentation requirements and customs procedures specific to importation of automobile products (vehicles and component parts)?

Please refer to Section 2.3.1 to check if your products are prohibited from import in Vietnam.

For the documentation requirements for the importation of vehicles, motorcycles and automobile parts for commercial purposes, please see general requirements under Section 2.2.1.

Additional documents include an import license and a registration for quality/technical standards conformity (see Section 2.3.3 for conformity assessment documentation).

Please note that the import of passenger cars under 16 seats may only be conducted via the following sea ports: Quang Ninh (Cai Lan), Hai Phong, Da Nang, Ho Chi Minh and Ba Ria - Vung Tau.

2.2.11. What are the documentation requirements and customs procedures specific to importation of power generating machinery?

See here.

2.2.12. What are the documentation requirements and customs procedures specific to importation of medical devices?

See here.

2.3. What import controls or non-tariff barriers might apply to my products?

2.3.1. What products are prohibited from import into Vietnam?

The list of prohibited imports into Vietnam as issued by the Government includes:

- Weapons, ammunition, explosive materials (except for industrial

explosives), and military technical facilities and equipment,

including:- Products bearing HS codes 3601.00.00, 3602.00.00, 3603, 8710.00.00,

8802, 8906.10.00, 9301, 9301.10.00, 9301.20.00, 9302.00.00, 9305,

9306; - Equipment for electronic warfare, breaking waves, jamming,

intercepting, monitoring radio and satellite communications

specialized for military use, including but not limited to:- Countermeasure and counter measurement electronics (i.e. equipment

designed to emit false, artificial, or jamming signals to radar or

transmitted radio receivers; communicate or interfere with the

reception, operation, or disablement of enemy electronic equipment)

including jamming and anti-jamming equipment; - Electronic equipment or systems designed for the purposes of

monitoring and testing the electromagnetic spectrum for military

intelligence and security purposes, or for use against such

surveillance; - Equipment for underwater countermeasures, including transmitters of

camouflage, interference, and equipment designed to generate false or

misleading signals to distract devices receiving ultrasound waves; - Equipment for data security, data processing, transmission and signal

transmission used in encryption and decryption processes to protect

state secret information (except for civil cryptographic products); - Equipment used in identification, authentication, key generation and

management, production and distribution of cryptographic equipment to

protect state secret information; - Specialized military guidance and steering equipment (such as

guidance or missile piloting technology); - Digital de-modulators specially designed for intelligence signals;

- Military communication machines, specialized military command

machines of all types;

- Countermeasure and counter measurement electronics (i.e. equipment

- Products bearing HS codes 3601.00.00, 3602.00.00, 3603, 8710.00.00,

- All types of firecrackers (except for flares used for maritime safety

pursuant to guidelines of the Ministry of Transport), sky lanterns,

and various types of equipment interfering with road traffic

speed-measuring instruments; - Type I chemicals stipulated in the Treaty Prohibiting Development,

Production, Storage, Use and Destruction of Chemical Weapons and

Appendix 1 to Decree 38/2014/ND-CP dated 6 May 2014 regulating

management of chemicals subject to control and listed on the above

Treaty; - Chemicals on the list of prohibited chemicals in Appendix 3 issued

with Decree 113/2017/ND-CP dated 9 October 2017 implementing the Law

on Chemicals (available only in Vietnamese); - Second hand consumer goods, medical equipment, and vehicles,

comprising the following groups of goods:- Textiles and garments, footwear and clothing;

- Electronic goods;

- Refrigerating goods;

- Household electrical appliances;

- Medical equipment;

- Home interior decoration goods;

- Household goods comprising of porcelain, terracotta and china, glass,

metal, plastic or similar resin, rubber, plastic articles and other

materials; - Bicycles;

- Motor vehicles and motorcycles;

- All types of cultural products in the category prohibited from

dissemination or circulation or for which there is a decision

suspending dissemination, circulation, recall, confiscation or

destruction in Vietnam; - Goods classified as second hand information technology products,

including products with HS Codes 8443.31.19, 8443.31.29, 8443.31.39,

8443.32.19, 8443.32.29, 8443.32.39, 8443.32.49, 8443.32.90, 8443.99.20, 84.70, 84.71, 85.17, 85.18, 85.25, 85.26, 85.27, 85.28, 85.34, 85.40, 85.42, 85.44.42.11, 85.44.42.13, 85.44.42.19, 85.44.42.21, 85.44.42.23, 85.44.49.11, 85.44.49.13, 85.44.49.19, 85.44.49.21, 85.44.49.22, 85.44.49.23, 85.44.49.24, 85.44.49.29, 85.44.49.31, 85.44.49.32, 85.44.49.39, 85.44.70.10, 85.44.70.90; - All types of publications in the category prohibited from

dissemination and circulation in Vietnam; - Postal stamps in the category for which trading, exchange, display or

dissemination is prohibited by the Law on Post (the English text of

which can be found here); - Wireless equipment and wireless wave application equipment that is

not compliant with the master planning on frequency and with the

relevant technical specifications in the Law on Radio Frequency

(the English text of which can be found here); - Right hand drive [RHD] vehicles (including vehicles in a disassembled

state and vehicles with a RHD mechanism which has been rearranged

prior to import into Vietnam), except for specialized use RHD

vehicles used on a small scale and not on road traffic. The latter

exceptions comprise of: cranes, canal and drain digging machines,

road sweepers, road watering vehicles, rubbish collecting vehicles,

road surfacing vehicles, passenger vehicles for airports, forklift

trucks for warehouses and ports, concrete pump trucks, and small

buggies for golf courses and parks; - Various types of automobiles, 4-wheeled motorized vehicles and sets

of components to assemble automobiles the frame number or engine

number of which has been erased, modified or re-stamped; - All types of motor bikes and mopeds the frame number or engine number

of which has been erased, modified or re-stamped; - All types of specialized automobiles and motorcycles the frame number

or engine number of which has been erased, modified or re-stamped; - Second hand materials and transport facilities comprising of:

- Machines, frames, tires and tubes, accessories and engines of

automobiles, tractors, mopeds and other motorized vehicles; - Chassis attached to automobiles, tractor engines (including new

chassis attached to second hand engines, and including second hand

chassis attached to new engines); - Various types of automobiles the structure of which has been modified

to convert the original designed function; - Various types of automobiles, motorcycles and mopeds (excluding any

second hand items), and 4-wheeled motorized passenger vehicles which

are second hand for more than five (5) years calculated from the year

of manufacture up until the year of import; - Ambulances;

- Machines, frames, tires and tubes, accessories and engines of

- Chemicals in Appendix III of the Rotterdam Convention (can be found

here). - Plant protection agents prohibited for use in Vietnam prohibited for

use in Vietnam (can be found here); - Specimens of rare and precious animals and plants listed in Appendix

I of CITES (can be found here) derived from nature

that are being imported for commercial purposes; - Specimens and processed products from white rhinoceros, black

rhinoceros and African elephants; - Scrap and waste, and refrigerating equipment using CFCs;

- Products and materials containing asbestos of the amphibole group;

Appendix 1 of this document denotes further goods prohibited from import based on their HS Codes.

2.3.2 Which types of products require import permits or licenses?

Import permits are required for the importation of the following products:

- Goods subject to the tariff quota regime of:

- Salt;

- Tobacco raw materials;

- Poultry eggs;

- Refined sugar and raw sugar;

- Chemicals and products containing chemicals:

- List 2 and List 3 chemicals in the Appendix A issued with Decree 38

of the Government dated 6 May 2014 on management of chemicals under

control pursuant to the Treaty Prohibiting Development, Production,

Storage, Use and Destruction of Chemical Weapons (only available in

Vietnamese); - Industrial precursors;

- List 2 and List 3 chemicals in the Appendix A issued with Decree 38

- Explosives materials and industrial explosives materials;

- Tobacco raw materials, tobacco products, tobacco/cigarette papers,

and specialized machinery and equipment used to produce tobacco and

replacement accessories; - Flares used for maritime safety;

- Plant protection agents not yet on the list of plant protection

agents permitted to be used in Vietnam in order to temporarily import

them for re-export or to import them for production in Vietnam for

the purpose of eventually exporting them pursuant to a contract

signed with a foreign party; - Plant protection agents used for fumigation purposes not containing

the chemical methyl bromide or other toxic chemicals of Type I and II

pursuant to the globally harmonized system of classification and

labelling of chemicals (GHS); - Plant protection agents not yet on the list of plant protection

agents permitted to be used in Vietnam, imported for testing and then

for registration as [legal] plant protection agents; - Plant protection agents not yet on the list of plant protection

agents permitted to be used in Vietnam, imported for testing and

research; or for use in an foreign investment project; or for use as

samples at an exhibition; or in other cases pursuant to decisions of

the Ministry of Agriculture and Rural Development (MARD); - Agents on the list of plant protection agents not permitted for use

used in Vietnam but imported as reference materials; - Animal breeding materials outside the list of those permitted to be

produced and traded in Vietnam, various types of insects which are

not yet found in Vietnam, and the essence of animal breeding

materials imported for the first time into Vietnam; - Seedlings for growing crops and raising plants for the purposes of

plant protection, and other objects on the list of those subject to

quarantine and plant pest risk analysis prior to importation into

Vietnam; - Seedlings for growing crops and plants not yet on the list of objects

permitted to be produced and traded in Vietnam and which are imported

for purposes of research, testing, trial production, or imported for

the purpose of international co-operation, samples at an exhibition,

as a gift or in order to implement an investment program or project; - Feed for livestock and raw materials for production of animal feed;

aquaculture feed and raw materials for producing feed for aquatic

creatures not on the list of items permitted to be circulated in

Vietnam; - Fertilizers not recognized for circulation in Vietnam in the

following cases:- For testing purposes, i.e., monitoring and evaluating criteria in

order to determine the method of use, impact on the environment,

agronomic efficiency and economic efficiency of fertilizers; - Specialized fertilizer used for sports stadiums and entertainment

areas; - Specialized fertilizer for enterprises with foreign owned capital to

assist production within the scope of the enterprise or to use in

foreign investments in Vietnam; - Used as a gift or sample;

- To be presented at a commercial fair or exhibition;

- Imported as a component part in production of fertilizer for export;

- For use in scientific research;

- Fertilizer raw materials in order to produce fertilizer;

- For testing purposes, i.e., monitoring and evaluating criteria in

- Genes of plants, animals, and micro-organisms for us in scientific

research and scientific and technical exchange; - Finished products not yet on the list of items permitted to be

circulated in Vietnam, or on the list of products the import of which

is conditional; - Marine seedlings not on the list of permitted items for first time

normal import into Vietnam; - Live products of aquaculture/fisheries not on the list of such

products permitted to be imported into Vietnam for use as food; - Postal stamps, publications on postal stamps and other lines of post

stamp articles; - Cybersecurity products comprising of:

- Products for testing and assessing network safety;

- Products for surveying network safety;

- Anti-hacking products;

- Medicines that are subject to special control (a list of which can be

found here); - Raw materials for production of medicines which must be subject to

special control; - Raw materials for production of medicines which do not have

certificates of registration for circulation in Vietnam, not

including raw materials for the production of medicines subject to

special control; - Reference materials and packaging which directly contacts the

medicine [contained therein]; - Medical equipment and facilities without a circulation number which

are imported for scientific research or for testing or for the

purpose of guiding the use and repair of medical equipment and

facilities; - Medical equipment and facilities without a circulation number which

are imported for aid purposes (these must be evidenced by aid

agreement and other supporting documentation); - Medical equipment and facilities without a circulation number which

are imported for use for purposes of individual medical treatment; - Medical equipment without a circulation number which is imported to meet urgent needs of fighting against and prevent of pandemic, overcoming the consequences of natural disasters and catastrophes;

- Used medical equipment imported for research and education purposes or temporarily imported for re-export for display and exhibition;

- Chemicals and chemical preparations which are imported for the

purposes of scientific research; - Chemical preparations which are imported for serving aid purposes; or

which are used for other special purposes (such as donations, or

where there are no products and methods of use consistent with use

demand of the applicant for import in a market); - Registered medical equipment containing narcotic substances or

precursors, or the materials for manufacture of medical equipment the

are narcotic substances or precursors; - Medical equipment containing narcotic substances or precursors being

imported for scientific research or inspection; - Raw materials for manufacture of medical equipment that may contain

narcotic substances or precursors and imported for scientific

research or inspection; - Raw materials for the production, extraction or refining of gold.

2.3.3. What technical requirements might apply to my imports, and how can I show proof of conformity with domestic and international standards?

2.3.3.1. General technical requirements and conformity assessment documentation

Goods are divided into two groups:

- Group 1 includes goods that cause no harm to humans, animals, plants,

assets, or the environment; - Group 2 include goods that can latently cause harm to humans,

animals, plants, assets, or the environment.

While the quality control of goods in Group 1 is based on applicable standards announced by producers, the quality control of goods in Group 2 is based on relevant technical requirements issued by relevant competent authorities.

All imported goods must have their applicable standards announced. Producers and importers shall announce fundamental properties, warning information and standard codes on goods or on (i) goods package; (ii) goods labels; or (iii) documents accompanying products or goods.

Imported goods of Group 2 must pass a quality inspection. The inspection of these goods includes the examination of conformity evaluation results, goods labels, standard or regulatory conformity stamps, and documents accompanying the goods subject to examination. In addition, imported goods samples must be tested according to announced applicable standards and relevant technical regulations as necessary.

Technical requirements for goods in Group 2 are issued by the government agency/ministry in charge of regulating the product.

Products and goods under the management authority of the Ministry of Agriculture and Rural Development, together with relevant technical standards/regulations and form of inspection can be found in Circular No. 16/2021/TT-BNNPTNT.

Products and goods under the management authority of the Ministry of Labour, Invalids and Social Affairs, together with relevant technical standards/regulations and form of inspection can be found in Circular No. 01/2021/TT-BLDTBXH.

Products and goods under the management authority of the Ministry of Public Security, together with relevant technical standards/regulations and form of inspection can be found in Circular No. 08/2019/TT-BCA.

Products and goods under the management authority of the Ministry of Industry and Trade can be found in Circular No. 33/2017/TT-BCT (available only in Vietnamese).

Products and goods under the management authority of the Ministry of Transport, together with relevant technical standards/ regulations and form of inspection can be found in Circular No. 12/2022/TT-BGTVT.

Products and goods under the management authority of the Ministry of Information and Communication can be found in Circular No. 02/2022/TT-BTTTT.

Products and goods under the management authority of the Ministry of Science and Technology can be found in Circular No. 01/2009/TT-BKHCN.

Products and goods under the management authority of the Ministry of Culture, Sports and Tourism can be found in Circular No. 24/2018/TT-BVHTTDL.

The registration dossier for the declaration of conformity with technical standards (Group 1)

The product owner shall make two sets of applications for registration of the declaration of conformity with technical standards. The first one shall be submitted directly or through post to the local Department of Standards, Metrology and Quality where the manufacturer is registered while the second application shall be kept with the product owner. The application shall include the following documents:

- If the declaration of conformity with standards is based on results

of certifying conformity by a registered certifying organization (a

third party to those involved in the import transaction), an

application for registration of the declaration on conformity with

standards shall include:- A completed declaration of conformity with standards document (found here);

- Original copies of documents proving business operation of the

organization or individual declaring product standard conformity (may

include enterprise registration certificates, investment registration

certificates or other equivalent documents); - An original copy of the applied standard;

- An original copy of the standard conformity certificate issued by the

registered certifying organization(s), enclosed with standard

conformity marking specimen;

- If the declaration of conformity with standards is based on the

results of self-assessment by the organization or individual (the

first party), an application for registration of the declaration on

conformity with standards shall include:- A completed declaration of conformity with standards document (found here);

- Original copies of documents proving business operation of the

organization or individual declaring conformity with product

standards (may include enterprise registration certificates,

investment registration certificates or other equivalent documents); - An original copy of the applied standard;

- In cases where the product owner has not yet obtained the

certificate of conformance with standards on quality management

systems (such as ISO 9001, ISO 22000 or HACCP, or other equivalent)

granted by a registered certifying organization, the application must

include the production process enclosed with the plan on quality

control formulated and applied (according to this form) and the

plan on supervising the quality management system; - In cases where the product owner has obtained the certificate of

conformance with standards on quality management systems (ISO 9001,

ISO 22000, HACCP, or other equivalent) granted by a registered

certifying organization, the application must include a copy of the

valid original certificate of conforming with standards on quality

management systems; - A report on assessing the conformity with standards (according to

this form), enclosed with an original copy of the test result of the

sample within 12 months calculated up to time of submitting

application for registration of the announcement on standard

conformity made by the registered testing organizations.

The registration dossier for the declaration of conformity with technical regulations (Group 2):

Organizations and individuals declaring conformity with the technical regulations shall prepare dossiers of their declaration of conformity and submit them directly or by post to the Ministry in-charge (see the list above). The dossier shall include:

- If the declaration of conformity is based on the self-assessment of

the organization or individual (first party), the dossier shall

include:- The declaration of conformity with technical regulations (using this

form) and the following additional content:- The self-assessment report, signed with a date by the leader of the

organization or individual, that shall include the below information.

The self-assessment report is based on the self-implementation of

the organization or individual. It can also be based on the

assessment of the registered conformity assessment organization.- The name of organization or individual; address; telephone and fax

number; - The names of products and goods;

- The number of technical regulations being declared to be inconformity

with; - The conclusion that the products/goods conform to technical

regulations; - A self-declared commitment to product and goods quality in accordance

with the technical regulations applicable standards, and the

commitment of taking full responsibility before the law for product and

goods quality and self-assessment results;

- The name of organization or individual; address; telephone and fax

- The self-assessment report, signed with a date by the leader of the

- The declaration of conformity with technical regulations (using this

- In cases where the declaration of conformity is based on the

certification results of a registered testing organization (third

party), a dossier for the declaration of conformity with technical

regulations shall include:- The declaration of conformity with technical regulations (using this form);

- The name of the registered testing organization, certificate number

and certificate issue date; - A copy of the original certificate of conformity for the relevant

technical regulations, enclosed with a specimen of the regulation

conformity seal, issued to the organization or individual by the

registered testing organization.

2.3.3.2. What are the technical requirements for imported medical equipment?

In addition to the declaration of conformity with standards/technical regulations and the associated certification mentioned above, the circulation of medical equipment in Vietnam’s market must meet the following conditions:

- Have an effective registration number or have obtained an import

license (except for medical gas);- There are certain exceptions to this, including:

- Medical equipment only serves the purposes of research, testing, inspection, testing, testing, quality assessment, training in the use and repair of medical equipment.

- Medical equipment imported into Vietnam for the purpose of aid or humanitarian medical examination and treatment or to serve activities of fairs, exhibitions, display, product introduction or for use for other purposes is a gift or a gift for a medical facility or for personal treatment, with personal characteristics or according to the special diagnostic needs of the medical establishment.

- Imported medical equipment that does not have a free-sale registration number to meet the urgent needs of disease prevention and control, and to overcome consequences of natural disasters or catastrophes, but other medical equipment that is available in the market is not available on the market. replaceability.

- Medical equipment manufactured in Vietnam for export purposes only or participating in overseas exhibitions, fairs and exhibitions.

- Software used for medical equipment.

- Medical equipment sold and purchased as normal goods and imported in the form of gifts to individuals or organizations not being health facilities.

- There are certain exceptions to this, including:

- Have a label or supplementary label containing sufficient

information. This should include the following:- Goods’ name;

- Name and address of the organization or individual responsible for

the goods; - Goods’ origin;

- Circulation number or the number of the license to import the medical

product; - The batch or serial number of the medical device;

- Date of manufacture and expiry date:

- Sterilized, single-use medical equipment, reagents, calibrators,

control materials, chemicals must have an expiry date; - In other cases, indicate the date of manufacture or the expiry date;

for medical machinery indicate the year of manufacture or month and

year of manufacture; - Warning information, instructions for use, storage instructions and

warranty information;

- Sterilized, single-use medical equipment, reagents, calibrators,

- Be accompanied by technical documents serving the repair and

maintenance of medical devices, excluding disposable medical devices

where said repair and maintenance is not prescribed by its

manufacturer; - Contain instruction in Vietnamese on how to use the medical devices;

The information required in the application dossiers differs depending on the classification of the medical equipment – this is regulated through the Department of Medical Equipment and Health Works (DMEHW) and outlined in Decree 98/2021/NĐ-CP (Medical Equipment Management) and its guiding Circular 05/2022/TT-BYT. The devices are classified into 4 classes (A, B, C and D) which are also categorized into two groups: group 1 (Class A – those of low level of risks) and group 2 (Class B – those of lower average level of risk , C – those of upper average level of risks, and D – those of high level of risks) based on the level of potential risks associated with the technical design and manufacture of such medical devices. The classification of medical equipment is conducted by qualified agencies.

Application dossiers for declaration of conformity of standards applications for medical equipment of Classes A or B

An application dossier for medical equipment of Class A and Class B must include:

- A written announcement of the application of standards for medical

equipment Class A or Class B; - A certificate of ISO 13485 quality management standard being valid at

the time of application; - A consularized or a copy of the consularized power of attorney of the

owner of the medical equipment for the applicant to announce the

applicable standards, still valid at the time of submission of the

application unless the applicant is a Vietnamese enterprise, business

household or cooperative and is the owner of the medical equipment; - A certificate of satisfaction of warranty conditions, issued by the

owner of the medical equipment, except for the case of single-use

medical equipment according to regulations of the manufacturer ,or

upon showing documents proving that there is no warranty; - A brief technical description of the medical equipment in Vietnamese,

enclosed with a technical document describing the functions and

specifications of medical equipment issued by the manufacturer; - For reagents, calibrators and in-vitro control materials: technical

documents in Vietnamese) together with documents on materials,

product safety, manufacturing processes, preclinical and clinical

research reports including stability reports; - A certificate of conformity or a copy of product standards announced

by the owner of the medical equipment; - A user manual for the relevant medical equipment;

- Sample label to be used when circulating medical equipment in

Vietnam; - A certificate of free sale still valid at the time of application.

Application dossiers for issuance of a registration number for medical equipment of Classes C or D for which there are no equivalent national technical regulations

The following is required for an application dossier for medical equipment of Classes C or D for which there are no equivalent Vietnamese national technical regulations.

- An application for a registration number;

- A certificate of ISO 13485 quality management standard being valid at

the time of application; - A consularized or a copy of the consularized power of attorney of the

owner of the medical equipment for the applicant to announce the

applicable standards, still valid at the time of submission of the

application, unless the applicant is a Vietnamese enterprise,

business household or cooperative and is the owner of the medical

equipment; - A certificate of satisfaction of warranty conditions, issued by the

owner of the medical equipment, except for the case of single-use

medical equipment according to regulations of the manufacturer ,or

upon showing documents proving that there is no warranty; - A certificate of free sale still valid at the time of application;

- Appraisal results of the general technical dossier on medical

equipment as prescribed by ASEAN (“CSDT”) by an agency appointed by

the Minister of Health together with the CSDT dossier; - For in vitro diagnostic medical equipment that are reagents,

calibrators, control materials, there must be an additional quality

certificate issued by a competent Vietnamese agency; - For chemicals and preparations that have only one purpose of

sterilizing medical equipment, either the following document must be

added: (i) A test sheet of ingredients and content of disinfectants

issued by a qualified agency; or (ii) A test sheet to evaluate the

biological efficacy of the product and the product’s side effects on

test participants issued by a qualified agency.

Application dossiers for issuance of a registration number for medical equipment of Classes C or D for which there are equivalent national technical regulations

The following is required for an application dossier for medical equipment of Classes C or D for which there are equivalent Vietnamese national technical regulations:

- An application for a registration number;

- A certificate of ISO 13485 quality management standard being valid at

the time of application; - A consularized or a copy of the consularized power of attorney of the

owner of the medical equipment for the applicant to announce the

applicable standards, still valid at the time of submission of the

application, unless the applicant is a Vietnamese enterprise,

business household or cooperative and is the owner of the medical

equipment; - A certificate of satisfaction of warranty conditions, issued by the

owner of the medical equipment, except for the case of single-use

medical equipment according to regulations of the manufacturer ,or

upon showing documents proving that there is no warranty; - A certificate of free sale still valid at the time of application;

- A certificate of conformity with technical regulations;

- A CSDT dossier.

2.3.3.3. What are the technical requirements for imported pharmaceutical products?

Importing and circulating pharmaceutical products in the Vietnamese markets requires, on top of the general technical requirements and documentation discussed above, specific expiry date and labelling standards.

Vietnam largely bases its technical regulations on international standards, practices and guidelines developed by bodies such as the WHO, OECD, the International Council for Harmonization of Technical Requirements for Pharmaceuticals for Human Use (ICH), amongst others.

Expiry dates of imported pharmaceutical products:

a) The expiry date of finished medicines with a shelf life of more than 24 months, must be at least 18 months from expiry upon the date of their arrival in Vietnam;

b) The expiry date of finished medicines with a shelf life of 24 months or less, must be at least 12 months from expiry upon the date of their arrival in Vietnam;

c) Vaccines and medical biological products without registration numbers must have at least 2/3 of their total shelf life remaining on the date of their arrival in Vietnam;

d) Vaccines and medical biological products with valid circulation registration numbers in Vietnam must have at least half of their shelf life remaining on the date of their arrival in Vietnam;

e) The expiry date of biological products used in -n-vitro diagnosis with a shelf life of 12 months or less must be at least three months after the date of their arrival in Vietnam;

f) The expiry date of raw materials used in making medicines, except for pharmaceutical materials, must be more than 36 months from the date of their arrival in Vietnam. Raw materials with a shelf life of 36 months or less must arrive at Vietnam’s ports at the latest six months after their date of manufacturing;

g) Drugs sent as part of humanitarian aid, rare drugs (the list can be found here) and drugs for hospital treatment (this has to be evidenced by an import dossier) must have a shelf life of 24 months or more and may only expire at a minimum at least 12 months after the date of their arrival at a Vietnamese port. If the drug has a shelf life of less than 24 months, the remaining shelf life from the date of arrival at a Vietnamese port must be at least 1/3 of the drug’s total shelf life;

h) Medicines and medical products that do not comply with the regulations on expiry dates of medicines mentioned above (except point e) but whose quality is still ensured and which need to be imported to serve the needs of treatment, or domestic production of medicine, might obtain import permits upon the consideration of the Vietnamese Ministry of Health’s Drugs Administration Department.

Labelling requirements of pharmaceutical products:

Labelling requirements include: the position and size of a label; the size of letters and numbers on a label; the colour of letters, symbols and images on a label; the language shown on a label; and presence of a secondary label and drug instruction sheet. Below are some of the key labelling requirements for pharmaceutical products:

- The outside package label of pharmaceutical products must include:

The drug name; dosage form; the composition of the drug, contents,

weights or concentrations of active ingredients or herbal

ingredients; package contents; indications, usage instructions and

contraindications; registration number or import license number (if

any); batch number, manufacturing date, expiry date, quality

standards and storage conditions; precautions and recommendations;

name and address of manufacturer; name and address of importer (for

imported drugs); and the origin of the product; - If the label of a product imported into Vietnam has no or

insufficient mandatory information in Vietnamese, a secondary label

containing mandatory information in Vietnamese is required and the

original label shall remain unchanged. The Vietnamese content shall

be consistent with the original label text; - If the secondary label is so small that it cannot contain mandatory

information, certain mandatory information must be written as

follows:- Indications, usage instructions, contraindications and other

information: please refer to the attached drug instruction sheet; - Clearly indicate how to find out the information about the

manufacturing date, expiry date and batch number printed on the

original label; - Registration number or import license number may be not specified but

information regarding registration number or import license number

(if any) must be specified before drugs are sold on the market and

after the registration number is issued by the Drugs Administration

of Vietnam or the import license number issued by the Ministry of

Health in case there is no registration application yet.

- Indications, usage instructions, contraindications and other

2.3.3.4. What are the technical requirements for imported cars?

Imported cars must meet national technical regulations/standards on, inter alia: fireproof safety structure; gas emission level 4; fuel consumption limit and determination methods; technical safety quality and environment protection; safety glasses; rear-view mirrors and air tires.

Please find here a complete set of applicable technical regulations and standards.

The importer must register to test their imported cars for compliance with these standards/technical regulations and obtain a Certificate of satisfaction illustrating compliance to be able to pass customs clearance procedures. This can be done at the Vietnam Register. Depending on the specific types (HS codes) of imported cars, they may be subject to a further need for satisfaction of standards/technical regulations after customs clearance and prior to circulation of the products in the market.

Recognition of international standards for motor vehicles

Products originating from the EU and falling under Chapters 40, 84, 85, 87 and 94 of HS 2012 will be subject to technical requirements included in UNECE (United Nations Economic Commission for Europe) regulations.

2.3.4. What are the current sanitary and phytosanitary (SPS) requirements for product imports into Vietnam?

Vietnam’s current SPS requirements include: plants quarantine, inspection for hygiene and safety of foodstuffs, and inspection for compliance with quality standards. Products subject to SPS requirements are categorized in the following groups:

- Plants;

- Animals;

- Land, fertilizers;

- Forestry;

- Agricultural products, foodstuffs;

- Fishery products;

- Other.

National technical regulations/standards for your products can be found here (in Vietnamese only; website currently unavailable, we will have an alternate link for you as soon as possible):

In Vietnam, the primary authority for developing and adopting SPS requirements is the Ministry of Agriculture and Rural Development.

The SPS requirements applicable to different types of products, can be found here (in Vietnamese only).

These SPS requirements are classified into those related to (i) food safety; (ii) animal quarantine; and (iii) plants quarantine.

2.3.5. What domestic Vietnamese taxes may apply to my imported products?

Your products could be subject to value added tax (VAT) and special consumption tax.

Generally, goods are subject to a 5% or 10% VAT. There are exceptions for certain goods that are exempt from VAT, or imports that are exempt from VAT under circumstances such as goods transiting through Vietnam’s territory, goods temporarily imported for re-export, etc.

Additionally, certain imports are subject to the special consumption tax, at a rate varying from 7% to 150% depending on the type of goods:

- Cigarettes, cigars and other tobacco preparations used for smoking, inhaling, chewing, sniffing or consuming orally;

- Liquor;

- Beer;

- Under-24 seat cars, including cars for both passenger and cargo transportation with two or more rows of seats and fixed partitions between passenger holds and cargo holds;

- Two- and three-wheeled motorcycles of a cylinder capacity of over 125 cubic cm;

- Aircraft and yachts;

- Gasoline of all kinds;

- Air-conditioners of 90,000 BTU or less;

- Playing cards;

- Votive gilt papers and votive objects.

The special consumption tax rates can be found here.

2.3.6. What information must be included on my products’ labels?

Generally, a product label must contain the following information: the product name, the name and address of the organization or individual who is responsible for the product, and the product origin.

A supplementary label presenting the compulsory information in Vietnamese is required for imported goods along with the original label. The information on the label must be the direct Vietnamese translation of the label in its original language. In addition, where the original label of imported goods does not fully contain the above compulsory information in Vietnamese, the importer must add a subordinate label in Vietnamese to the goods before or after customs clearance but before their circulation in the market.

Depending on the types of goods imported and the specific laws governing such goods, there may be additional compulsory labelling requirements. Please refer to this document for these labelling requirements.

Please see the above Section 2.3.3.3 for specific labelling requirements for pharmaceutical products.

2.4. What trade remedies might Vietnam apply against my imports?

Vietnam imposes additional duties or measures on imported goods if these goods cause: (i) injurious dumping; (ii) injurious subsidization or (iii) in case of injurious sudden increases of imported goods.

2.4.1. Anti-dumping duties

Under Vietnamese domestic law, imported goods are subject to anti-dumping duties if an anti-dumping investigation shows that the export price of the imported goods is lower than its normal price, thereby causing or threatening to cause material injury to the affected domestic industry.

Currently Vietnam does not impose any anti-dumping duties on goods imported from the EU.

2.4.2. Countervailing duties

Whilst anti-dumping duties address the private commercial conduct of exporters, countervailing measures address certain types of subsidies granted by governments. Countervailing measures are applied where the subsidized goods imported into Vietnam cause substantial injury or threaten to cause material injury to the domestic industry or prevent the formation of a domestic industry.

Currently Vietnam does not impose any countervailing duties on goods imported from the EU.

2.4.2. Safeguard measures

Safeguard measures are measures applied in cases where goods are excessively imported into Vietnam, causing serious damage or threatening to cause damage to the domestic industry.

Safeguard measures include applying (i) safeguard tax, (ii) import quotas; (iii) tariff quotas; (iv) import permits; and other safeguard measures.

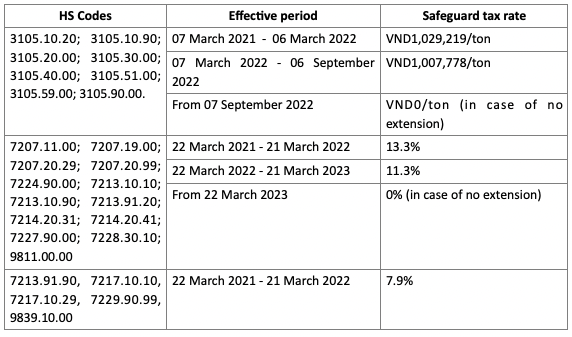

Currently Vietnam imposes safeguard tax on the following imported goods (including those imported from the EU but excluding those imported from Bulgaria and Romania):